Chapter 13: Case Study 1: Banking Project

Assume a bank is planning to develop online banking portal for its customers. So let us write business requirement for this in step by step manner. This case study gives you an overview of how to collect and document the business requirements.

1.Introduction

1.1 Purpose

Purpose of this document is to describe requirement for Online Banking portal to be launched by the bank.

1.2 Definition of Terminologies Used

| OBP | Online Banking Portal |

| OTP | One Time Password |

1.3 Listing of Supporting Documents

If you have any supporting documents provided it can attached here

1.4 Business Context

To describe the requirement and approach for online banking portal.

1.5 User Characteristics

Generally, operational users will use this document as a reference guide on the business rules and business processes. System analyst team will use it to prepare their functional specification document and program specification document and code the program. Business Analyst will Keep this signed-off document as a recorded business rules and they may use this document to prepare system-training manual/user training manual, if any.

2.Project Boundaries

2.1 Assumptions

Core banking application is already exists, it remains unchanged and this project has no impact on it.

2.2 Dependencies

Not applicable

2.3 Constraints

Not applicable

3. Business Requirements

3.1 Product Objectives

This project is being taken up to achieve the following objectives:

- To provide better and convenient banking experience to customers

- To increase the customer base

- To reduce the operational cost in long term

- Online presence and branch building

3.2 Background

Currently there is no online banking portal exists.

3.3 Problem and improvement areas

No Applicable

4. Scope of work

Initially in the first phase following functionalities need to be available.

Account Creation

New customer should be able create account using the debit card given to the customer while opening the account. Customer need to provide mandatory mobile number during the account opening. This will be used for authentication during online account creation and future online transactions.

Login

Once customer creates account should be able to login immediately.

Account Statement

Mini statement for last 10 transactions should be available. Also customer should be able to down statement in PDF format for last and current financial year. For the statement older than the last financial year customer need to request separately.

Add Beneficiary

Beneficiary should be able to add for fund transfer. Beneficiary activation should be done using OTP sent to registered mobile number. Fund transfer should be enabled only 24 hours the beneficiary addition.

Delete Beneficiary

Beneficiary added earlier should be able to delete.

Fund Transfer

Fund transfer method NEFT, RTGS and IMPS should be available. Funds can be transferred only after beneficiary addition & activation. There will be 24 hours waiting period for fund transfer after beneficiary activation.

For all the transactions online banking portal need to communicate with the CBA to get the details.

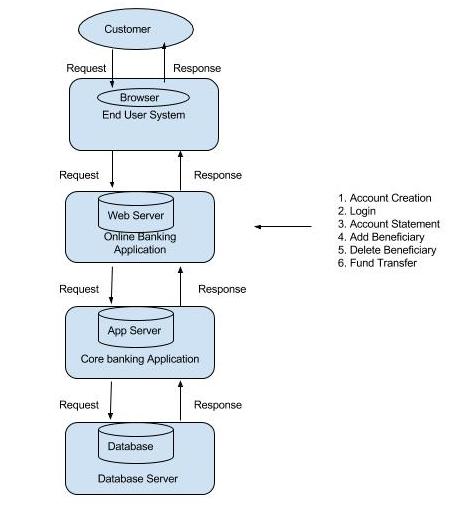

5. System Architecture

Online Banking System Architecture

6. Process Flow Diagram

Not Applicable

7. Process Steps

Not Applicable

8. Report Requirements

- Daily Report: Online Banking Portal Registered Users Report

- Weekly Report: Online Banking Portal Registered Users Report

- Monthly Report: Online Banking Portal Registered Users Report

9. Interface Requirements

Not Applicable

10. Acceptance Criteria

As per the business requirement.

11. Operational Scenarios and Illustrations

Not Applicable

12. Any other Details and Requirements

Not Applicable

13. Appendix

If you have any additional document/details you can provide here.

14. Checklists

Following are the few sample list of questions you may need to ask and get answer.

- Is there any impact to core banking system?

- Is there any impact to marketing team? If yes what is the impact?

- Is there any impact to sales team? If yes what is the impact?

- Is there any changes existing jobs?

- Whether any new job to be included?

- Whether any new transaction to be included?

- Whether any external vendor is involved? If yes, what is the role of the vendor?

- Any new communication mechanism involved?

- Any new documents to be used?

- Any change to existing document required?

- Any new training required for any team?